Public insurance adjusters are licensed professionals who work on behalf of policyholders by helping them file insurance claims for a fee. Public insurance adjusters can either work for businesses or individuals, but not insurance companies. Their work is crucial to any policyholder because it helps them get the most out of their policy’s coverage in case of a loss.

What is a Public Insurance Adjuster?

Public insurance adjusters are property loss professionals who tirelessly work for policyholders. Businesses and individuals seek the services of public insurance adjusters when they want to file a claim or if they feel that the claim amount offered by an insurance firm is way less than they expected.

Whatever your loss is, be it a claim for hurricane damage, wind, smoke, fire, floods or any other insurable peril, a public adjuster will be there to negotiate on your behalf to ensure that you get the best compensation possible. Public adjusters also deal with different types of losses. For instance, they can evaluate losses that affect business incomes.

What Does a Public Adjuster Do for You?

Like any other qualified professional, public adjusters have vast experience in what they do since they spent a considerable amount of their time studying and being experts at their profession. They know the ins and outs of the insurance paths taken by all insurance companies. They are skilled at breaking down and deciphering the technical terms spelled out in insurance policies; the insurance jargon. Public adjusters are the best at adjusting and filing claims. These state-licensed professionals offer unmatched services that leave wide smiles on the faces of their clients.

When to Choose a Public Adjuster

Everyone with an insurance claim should seek the services of a public adjuster. Working with a public adjuster is not only advisable, but it is also the most prudent thing to do during times of crisis when your judgment may be clouded. Any policyholder needs the services of a public adjuster so as not to self-destruct during such hard times.

It is not unusual for insurance firms to offer policyholders lower payouts when it comes to settlements. Most policyholders are utterly dismayed when they receive a check from their insurance firm. The look on their faces describes a person who has been delighted and disgusted by a sick joke at the same time; more like a dry joke with nothing to smile about. In as much as one may have received a cheque from their insurer, the cheque is nothing short of a pocket change that isn’t worth mailing. It is for this reason that all policyholders who have suffered a loss should seek the services of a licensed public insurance adjuster. To get what they rightfully deserve from their insurer. Public insurance adjusters are well equipped for their job for they use sophisticated software to evaluate a policyholder’s loss accurately. They make sure that you never get a coin less than what you deserve.

Another advantage of hiring licensed public adjusters is that they help save your time. The process of going after insurance firms every time to follow up on the progress of your claim settlement is exhausting. The daunting process can take a toll on your sanity when you are trying to balance your everyday activities such as work, seminars, or game practice with appointments with your insurer.

Public Vs. Independent and Company Adjusters

To determine the amount that should be paid out, policyholders, businesses and insurance firms all use adjusters for evaluation. Just like there are different types of engineers, there are three different types of adjusters: independent adjusters, company adjusters, and public adjusters.

Company adjusters work for insurance firms. Their work is to evaluate losses and determine how much should be paid to policyholders who seek compensation after suffering a loss. Company adjusters work for the best interest of an insurance firm to ensure that they make as much profit as possible.

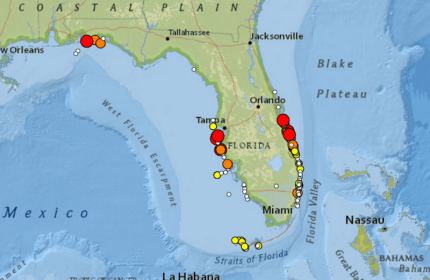

Independent adjusters work on a contractual basis; they are not permanent employees at insurance companies. They may be hired by an insurance firm at a particular time to handle a specific type of loss claimed by policyholders. For instance, when people from a particular location suffer losses as a result of a catastrophic hurricane, an insurance firm may seek the services of independent adjusters to help them deal with the situation at hand.

Lastly, there are public adjusters. These are professionals who work on behalf of the policyholder to ensure that the policyholder is not disadvantaged by a loss. They ensure that their clients get a fair claim settlement that puts them back on their feet as soon as possible.

Are the Services of a Public Adjuster Necessary?

Just like an ailing person consults a doctor, anyone who has suffered an insurable loss and is ready to make a claim should seek the services of a public adjuster. Doing so is crucial especially if the claim is for a lot of money. Policyholders who use the services offered by public adjusters have nothing to lose and everything to gain. You might be wondering why I say they have everything to gain. It is because public adjusters are paid on a contingency basis. They only get paid after your claim is settled. They get a certain percentage from your claim settlement. In other words, working with a public adjuster is great because the more the payout, the more their commission. What this means is that public insurance adjusters always work tooth and nail to ensure that their clients get a maximum payout. A policyholder’s win is their win.

Additionally, most public insurance adjusters offer to visit the place where the loss occurred for free to give their opinion about the insurable loss and what steps to take next. They determine the severity of the damage and provide a step by step advice on what should be done in order to be compensated at the earliest time possible. Even if you are confident about your payout, it is essential to get a second opinion from an expert.

Most times when a public adjuster visits a business or a home, they find out that the loss estimate is way below what it ought to be. Public insurance adjusters are super keen, and they are unlikely to leave out costs that would be omitted by a policyholder during their calculations. For example, if a house is destroyed by water damage, the homeowner may only calculate the cost of fixing the problem and bringing things back to normal and leave out the cost of getting rid of the flooded water.

Submitting a detailed and accurate claim is important because it plays a significant role when it comes to getting the rightfully deserved compensation from an insurance firm. Remember that your insurer is in the business purely for profits and an insurance company will never pay more than the amount specified in a claim. Policyholders need to be careful when claiming the right amount. Hiring a public insurance adjuster is the first step anyone can make when they want to get their desired results.

How Much Should I Pay A Public Adjuster?

A public adjuster does not have a fixed rate when it comes to payment for services delivered. The amount payable to public adjusters is usually capped and differs from state to state. However, all public adjusters are paid on a contingency basis meaning that they get a certain amount only after a policyholder is paid. Public insurance adjusters charge a certain percentage from the claim settlement. The rate mostly differs from 10% to 15%. For instance, if a policyholder receives a $100,000 payout from his or her insurer, his or her public adjuster is entitled to $10,000. If the policyholder gets nothing at all, then the public adjuster has nothing to claim from the policyholder.

How to Choose a Public Adjuster

Coming across a suitable public is not a walk in the park. There are some aspects that one should consider before hiring one. Some of these aspects are listed below.

• Experience

The experience of a public adjuster is the most important thing a policyholder should consider before hiring. A more experienced public adjuster charges more than a less experienced public adjuster charges. If you want to know if a public adjuster is more experienced, ask him or her how many claims he or she has handled or for how long the public adjuster has been in the adjusting industry. However, the number of years or the number of claims a public adjuster has handled does not necessarily mean they are experienced. A public adjuster may choose to handle some few cases with larger payouts in a year; this does not mean that they are not experienced.

• License

Confirming if a public adjuster is licensed is the most crucial factor. Ask the public adjuster for his or her license to prove that he or she is indeed qualified to handle your case. Alternatively, you can check the status of a public adjuster through various platforms such as the NAPIA website.

• Referrals

Before hiring a public adjuster, ask around for user experience. Take the advice of people who have worked with a public adjuster. If you do not know anyone who can make a recommendation, ask the public adjuster you are about to hire for a contact list of clients he or she has worked with before so that you can confirm about their experience working with the public adjuster.